Explain Difference Between Owner's Capital Account and Equity

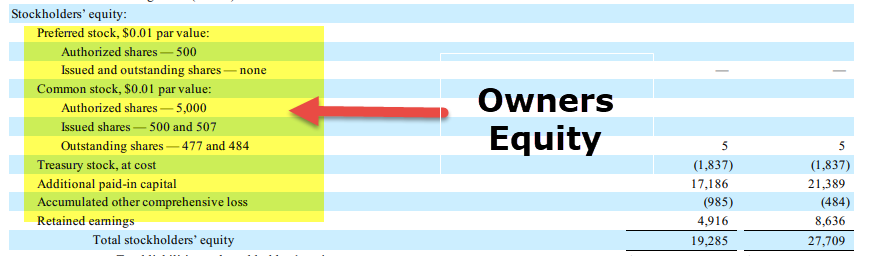

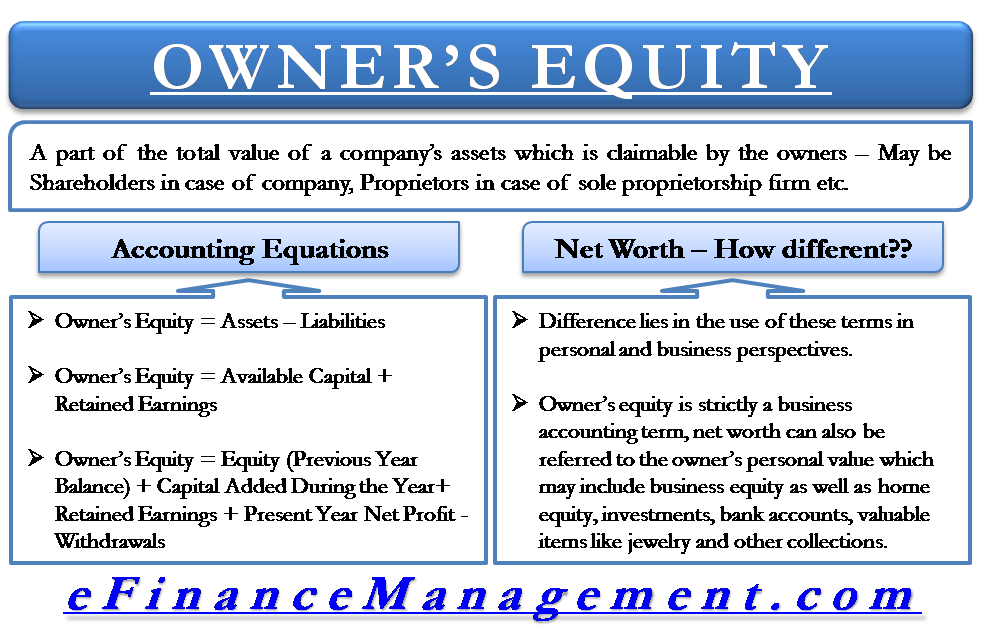

The equity of a company gets divided into several units and each unit is called a share. Owners Equity Assets - Liabilities.

Owner S Equity Definition Formula Examples Calculations

There are certain advantages to choosing equity capital over debt capital one of which is its ease of acquisition.

. But its not the only subcategory. The similarity between equity and capital is that they both represent interest that owners hold in a business whether it is funds shares or assets. Liabilities are amounts that are owed by the firm.

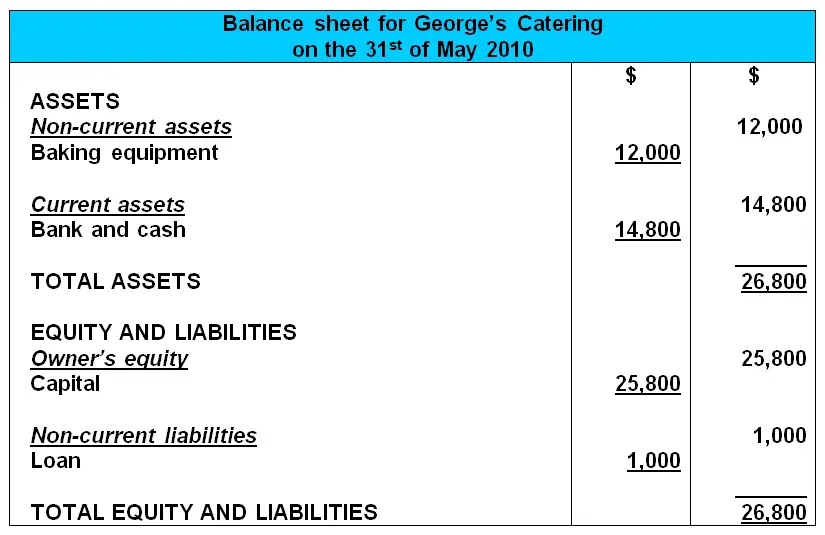

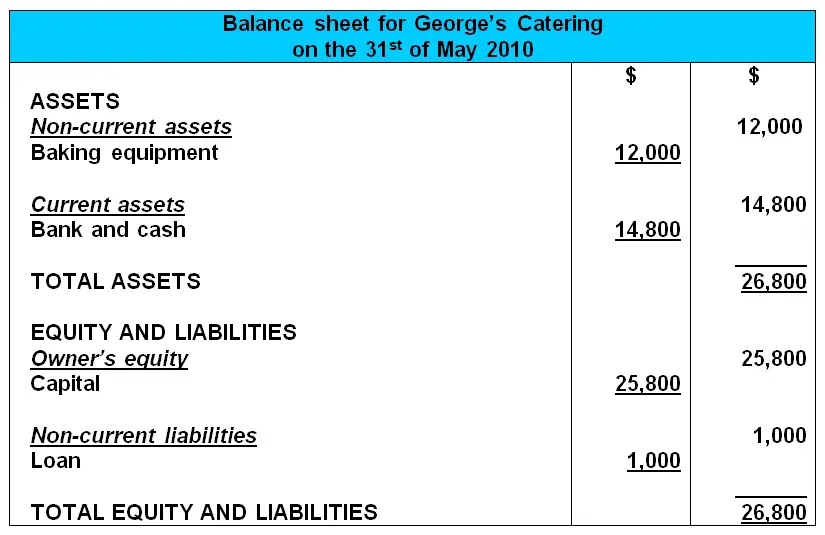

Capital is the owners investment of assets in a business. The accounting equation shows that the equity or capital in a firm is equal to the difference between the value of its assets and liabilities. Assets can be owned by the owner or owed to external parties - liabilities or debts.

Shareholders equity is the difference between a company. So your chart of accounts could look like this. Business owners use equity to assess the overall value of their business while capital focuses only on the financial.

Will be better if reply with an example. Equity also known as owners equity is the owners share of the assets of a business. When you put money in the business you also use an equity account.

Equity capital differs in the sense that it does not require the business owner to take on debt. Owners equity is that portion of capital which is invested by actual owners of business while share capital is that portion of capital which is invested by third parties or investors in business. Equity Capital is the total amount of funds invested by the owners in their business.

Inherent to this process is the promotion of diversity in teams and personnel public health practice research. The terms owners equity and capital both exist on the balance sheet but each of these two entities has its own definition within the accounting world. Please guide that what is the difference between partners equity and partners contribution accounts.

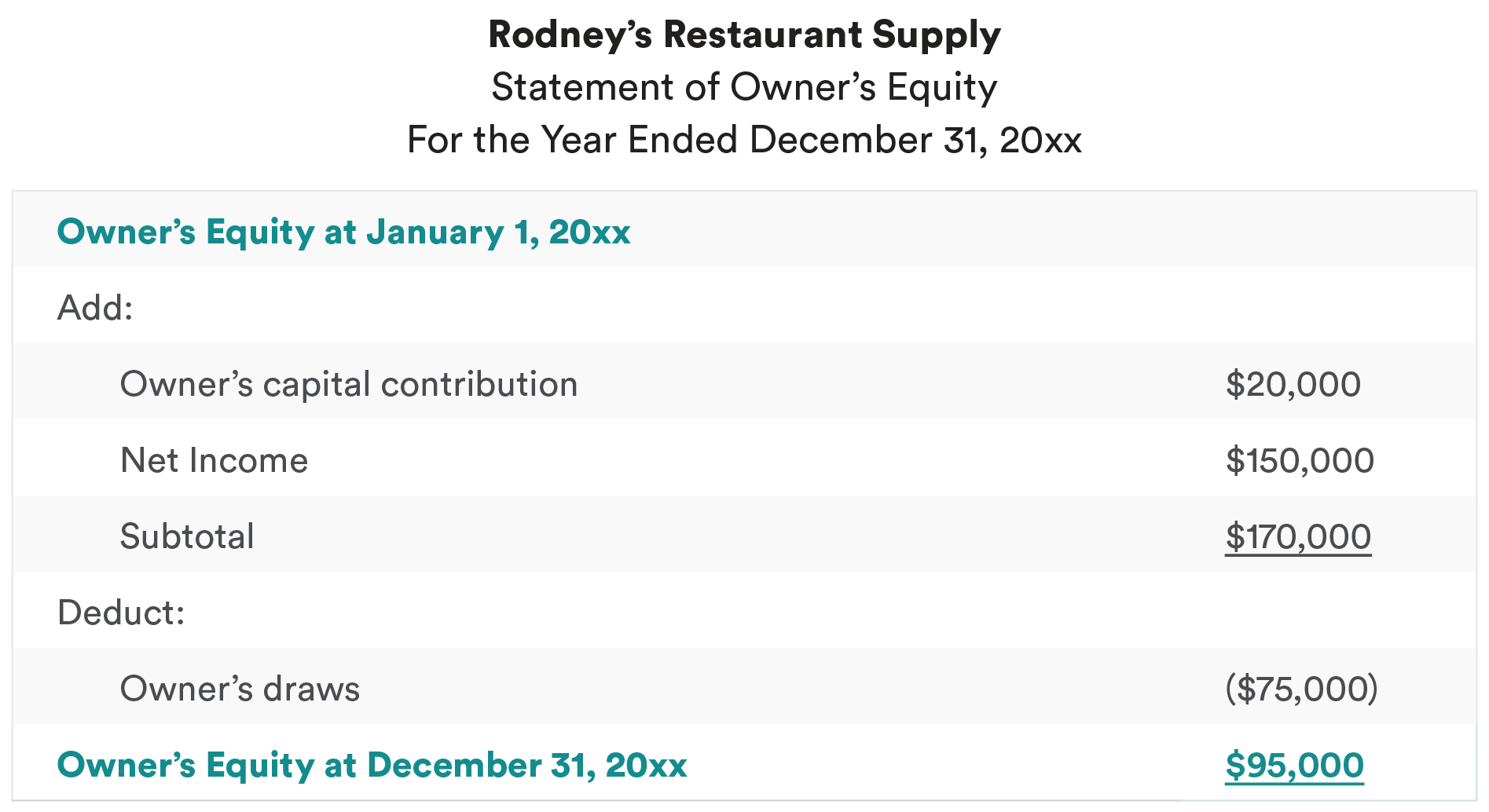

The owners can sell some of these shares to the general public to raise funds. Furthermore capital is used in calculation when deriving the value of equity as shareholders equity is the sum total of financial capital contributed by the owners and the retained earnings in the balance sheet. For a sole proprietorship or partnership the value of equity is indicated as the owners or the partners capital account on the balance sheet.

Owner Equity parent account Owner Draws sub account of owner equity Owner Investment sub account of owner equity View solution in original post. Equity capital is collected by issuing ordinary share. View the full answer.

Instead investors buy partial ownership equity in the business without requiring the business owner to repay the funds. Capital is the owners investment of assets into a business. Owner draw is an equity type account used when you take funds from the business.

I have already posted this question but wrongly in US-Community. Equity also known as owners equity is the difference between the total assets and total liabilities of a business. The main differences between Equity Share Capital and Preference Share Capital are as follows.

When partners equity will be used and when partners contribution account will be used. Both equity and debt capital are used for raising funds required in the business. Equity represents the total amount of money a business owner or shareholder would receive if they liquidated all their.

Switch to smart accounting software. Here are some key differences between equity and capital. The owners equity is always indicated as a net amount because the owners has contributed capital to the business but at the same time has made some withdrawals.

Owners Equity Assets. However the key difference between capital and equity is that capital is the total amount of money invested in starting a business. A companys equity typically refers to the ownership of a public company.

Understanding the difference between health equality and health equity is important to public health to ensure that resources are directed appropriately as well as supporting the ongoing process of meeting people where they are. The fund invested by the owner in the business or the net amount claimable by the owner from the business is known as the Capital or Owners Equity or Net Worth. Equity or owners equity is the owners share of the assets of a business assets can be owned by the owner or owed to external parties - debts.

The suppliers of the equity capital bear losses. Equity or owners equity is the owners share of the assets of a business assets can be owned by the owner or owed to external parties - debts. For a small business owner equity is the net worth of your business.

For a sole proprietorship or partnership equity is usually called owners equity on the balance sheet. When you take all of your assets and subtract all of your liabilities you get equity. In contrast equity is the shareholders share in a company.

The basic accounting equation is Assets Liabilities Owners Equity. Therefore profits from a business are also part of equity. In a corporation equity is shareholders equity.

Expressed in another way. Equity Share Capital is the funds that a company has generated by issuing Equity shares. Capital is the owners investment of assets in a business.

A companys equity and shareholder equity are not the same thing. See our tutorial on the basic accounting equation for more on this. While the motive is the same raising funds there are differences between the two as under- Equity Capital Debt Capital Meaning Involves selling a stake of the compa.

Equity is a form of ownership in the firm and equity holders are known as the owners of the firm and its assets. In other words the value of a businesss assets is equal to what the business owes to others liabilities plus what the owners own owners equity. Also guide reg use of community.

Capital is a subcategory of owners equity. Equity capital is part of the capital structure owned by ordinary shareholders. The Dividend Rate in the case of Preference Share Capital is not.

Ownership capital Equity capital Owned Capital refers to the Capital collected by issuing various types of shares. For example if a business has total assets worth 100000 and total liabilities of 30000 the owners equity in the business is equal to 70000 100000 30000. Preference Share Capital is the funds that a company has generated by issuing preference shares.

Owner S Equity Definition Accounting Equations Vs Net Worth

Owner S Equity What It Is And How To Calculate It Bench Accounting

Balance Sheet Owner S Equity Statement And Income Statement Temporary Vs Permanent Accounts

No comments for "Explain Difference Between Owner's Capital Account and Equity"

Post a Comment